Simple, Comprehensive, and Scalable

The Indian Partnership Act, 1932 which came into force on 1st October 1932 governs the law of partnerships in India. The definition of a partnership firm is '...the relation between persons who have agreed to share the profits of business carried on by all or any of them acting for all...' Further, since it is a legal entity created between two or more persons, the relevant provisions of the Indian Contract Act, 1972 shall also have application.

It is important to understand the key features of a Partnership firm in India and its legal implications, because this plays an important role in designing the structure of a new businesses.

Regulations and Framework

Features / elements of a partnership firm

- Comes into existence by way of a contract

- It is an association of two or more persons

- Created to share the profits of a business

- The business can be carried on by all or any partner on behalf of all

- Minors can be admitted to the benefits of a partnership – not losses

- All partners have rights and duties towards other partners and to the partnership firm

Types of Partnerships

Partnership At Will

It is a perpetual partnership, hence there is no provision with respect to the duration or life of the partnership. The partnership will continue to exist till any or all of the partners dissolve the partnership out of their own will by following the steps in 'Dissolution of a Partnership Firm'.

Particular Partnership

A particular partnership is formed for a particular period or for specific activity or a business venture or project. Such type of a partnership is dissolved automatically on completion of the venture or on expiry of the fixed term.

Step-by-step process to create a Partnership Firm

A partnership firm is created by means of a written agreement between partners. However, it is important to note that a valid partnership can even be created orally, or it can be an implied partnership (due to acts of persons undertaken jointly).

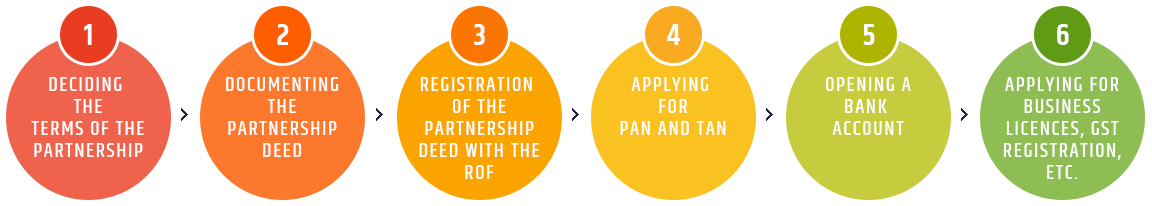

The following are the steps in starting a business under Partnership in India

Step 1 : Deciding the terms of Partnership

The first task for commencing a partnership business in India is deciding the objective of the firm, type of partnership to be created, the partners roles and responsibilities, etc., which will form the basis for documenting the partnership deed.

Step 2 : Documenting the Partnership Deed

A vital step in incorporating a partnership business is the Partnership deed which is the guiding document for all activities of the firm, and it should cover the following

- The Name of the Firm

- Principal place of business (address of the firm)

- Objective and nature of business

- Names and addresses of all the Partners

- Date on which each partner has joined the firm

- Profit sharing ratio among the partners

- Duration of the firm

- Roles and responsibilities of each partners

- Rights and duties of each partners

- Dispute resolution mechanism

Step 3 : Registration of Partnership Deed with ROF

All partnership businesses must be registered with the Registrar of Firms (ROF) of the state in which the business is located. The following are the steps involved in registration for a partnership firm with ROF Maharashtra.

- Online application in Form A to be made to the ROF for registration (duly signed and notarized)

- Submission of the following documents to be made along with Form A

- Covering letter (with requisite court fees stamp)

- Certified true copy of Partnership deed in English – attested by a Chartered Accountant

- Certified true copy of Partnership deed in Marathi – attested by a Chartered Accountant

- Affidavit (in the prescribed form) to be submitted on a stamp paper

- Payment of prescribed fees in cash/ pay order

Step 4 : Apply for PAN and TAN

Application of PAN and TAN can be made using a copy of the partnership deed alone. Hence, one need not wait for the application to ROF and can proceed with this step.

Step 5 : Opening of a Bank Account

Under normal circumstances, a bank account cannot be opened without a valid PAN and TAN and accompanied with a copy of registration application made to the ROF.

Step 6 : Applying for Business Licences, GST Registration, etc.

The final step in commencing a business under partnership is applying for all business licences, permissions, and GST registration, etc., on opening of a valid bank account.

Other Ongoing Tasks

Apart from incorporation of a partnership firm, there are various other matters that need to be dealt with during the life of a partnership firm. Some of these are

- Amendments in partnership deed and registration with ROF

- Admission of a partner, retirement/ death of a partner

- Expulsion of a partner

- Insolvency of a partner

- Insolvency of the firm and duties of partners

A Partnership firm is ideal for small, closely held businesses with limited scope of operations. It is easy to manage and a great first step for small entrepreneurs. V. Purohit & Associates has the required expertise and resources to help you get started.

We are a new-age financial accounting company, that upholds age-old values and principles of Chartered Accountancy. We offer a fairly-differentiated set of services, tailored to specific business goals and challenges.